Little Known Facts About Melbourne Home Loan Broker.

Wiki Article

Little Known Questions About Melbourne Home Loans.

Table of ContentsNot known Details About Melbourne Home Loan Broker The Facts About Melbourne Home Loans RevealedThe Basic Principles Of Home Loans Brokers Melbourne The 5-Minute Rule for Home Loans Brokers MelbourneThe Single Strategy To Use For Home Loans Brokers Melbourne

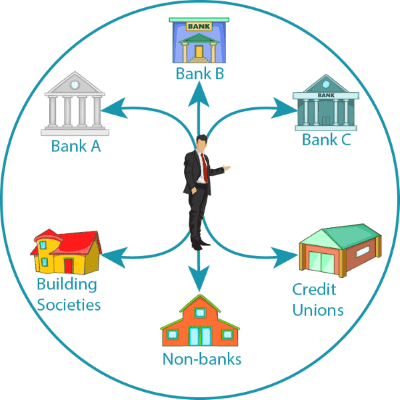

We independently assess all advised products and services. Home mortgage brokers help would-be consumers discover a lender with the best terms and rates to meet their monetary demands.Functioning with a knowledgeable, competent mortgage broker can assist you find the best mortgage. All the exact same, there are benefits and negative aspects to utilizing a mortgage broker.

They additionally accumulate and confirm all of the necessary documents that the loan provider requires from the consumer in order to complete the home purchase. A home loan broker usually deals with lots of different lending institutions and can supply a selection of car loan alternatives to the consumer. A borrower doesn't need to deal with a home mortgage broker.

How Melbourne Home Loans can Save You Time, Stress, and Money.

They'll respond to all concerns, aid a borrower get pre-qualified for a financing, and help with the application process. They can be your advocate as you function to close the loan. melbourne home loan broker. Home loan brokers don't give the funds for car loans or authorize finance applications. They help individuals seeking mortgage to discover a loan provider that can fund their home purchase.

Ask buddies, relatives, and organization colleagues for recommendations. Have a look at online testimonials and look for problems. When meeting prospective brokers, obtain a feeling for just how much rate of interest they have in assisting you get the lending you require. Inquire about their experience, the exact aid that they'll provide, the charges they bill, and how they're paid (by lender or customer).

The Home Loans Melbourne Statements

A good broker collaborates with you to: Recognize your demands and objectives. Work out what you can afford to borrow. Locate choices to fit your scenario. Clarify exactly how each funding jobs and what it costs (for instance, rates of interest, features and charges). Obtain a car loan and handle the procedure with to settlement.Some brokers get paid a standard cost regardless of what lending they suggest. Other brokers obtain a higher cost for using specific financings.

If the broker isn't on one of these checklists, they are running unlawfully. Prior to you see a broker, believe about what matters most to you in a home financing.

Rumored Buzz on Home Loans Melbourne

Make a listing of your: 'must-haves' (can't do without) 'nice-to-haves' (might do without) See selecting a home mortgage for guidance on what to think about - melbourne home loan broker. You can locate an accredited home loan broker via: a home loan broker expert association your loan provider or monetary establishment suggestions from people you know Bring your listing of must-haves and nice-to-haves

Get them to clarify exactly how each finance alternative works, what it sets you back and why it's in your best interests. If you are not satisfied with any kind of option, ask the broker to find options.

The Main Principles Of Home Loans Brokers Melbourne

Never authorize blank kinds or leave details for the broker to load in later. Or go to one more broker.Describe the trouble and exactly how you 'd like it fixed. If the issue isn't taken care of, make a problem to your broker's company in composing. See just how to grumble home loans brokers melbourne for help with this. If the problem is still not fixed, call the Australian Financial Complaints Authority to make an issue and obtain cost-free, independent dispute resolution.

Report this wiki page